Traditional 401k to roth 401k conversion tax calculator

Ad Strong Retirement Benefits Help You Attract Retain Talent. The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn.

Roth Solo 401k Contributions My Solo 401k Financial

Ad If you have a 500000 portfolio download your free copy of this guide now.

. The main drawback of converting a traditional 401k into a Roth 401k is the tax bill that comes with making the switch. Yet keep in mind that when you convert your taxable retirement assets into a Roth IRA you will. Reviews Trusted by Over 45000000.

Traditional 401k Calculator helps you decide which investment will better prepare you for retirement. Reviews Trusted by Over 45000000. Roth 401 k Conversion Calculator.

1 The value of the account after you pay income taxes on all earnings and. Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. Converting to a Roth IRA may ultimately help you save money on income taxes.

This calculator will demonstrate the difference between taking a lump-sum payment from your 401 k and saving it in a tax-deferred account until retirement. Make a Thoughtful Decision For Your Retirement. This calculator will analyze your information and.

Ad If you have a 500000 portfolio download your free copy of this guide now. Traditional or Rollover Your 401k Today. 401k IRA Rollover Calculator.

Otherwise you would do so and you. 19500 or 26000 in 2021 or 20500 in 2022 with the 6500 catch-up amount. Find additional resources at MassMutual.

With the passage of the American Tax Relief Act any 401 k plan that allows for Roth contributions will now be eligible to convert. Youre going to have to pay taxes on that money. So when you roll over a traditional 401 k to a Roth IRA youll owe income taxes on that money in the year when you make the switch.

Roth IRA Conversion Calculator to Calculate Retirement Comparisons. Ad Learn More About Our Roth Traditional IRA Accounts Well Help You Roll Over Your 401K. With a Focus on Client Goals American Funds Takes a Different Approach to Investing.

Roth 401 k vs. A Roth conversion is an optional decision to change part or all of an existing tax-deferred retirement plan such as a 401k or a traditional IRA to a Roth IRA. Traditional 401 k Calculator.

Consider The Different Types Of IRAs. Roth Conversion Calculator Methodology General Context. Ad Explore Your Choices For Your IRA.

The contribution limits on a Roth 401 k are the same as those for a traditional 401 k. The Roth 401 k allows you to contribute to your 401 k account on an after. Get Up To 600 When Funding A New IRA.

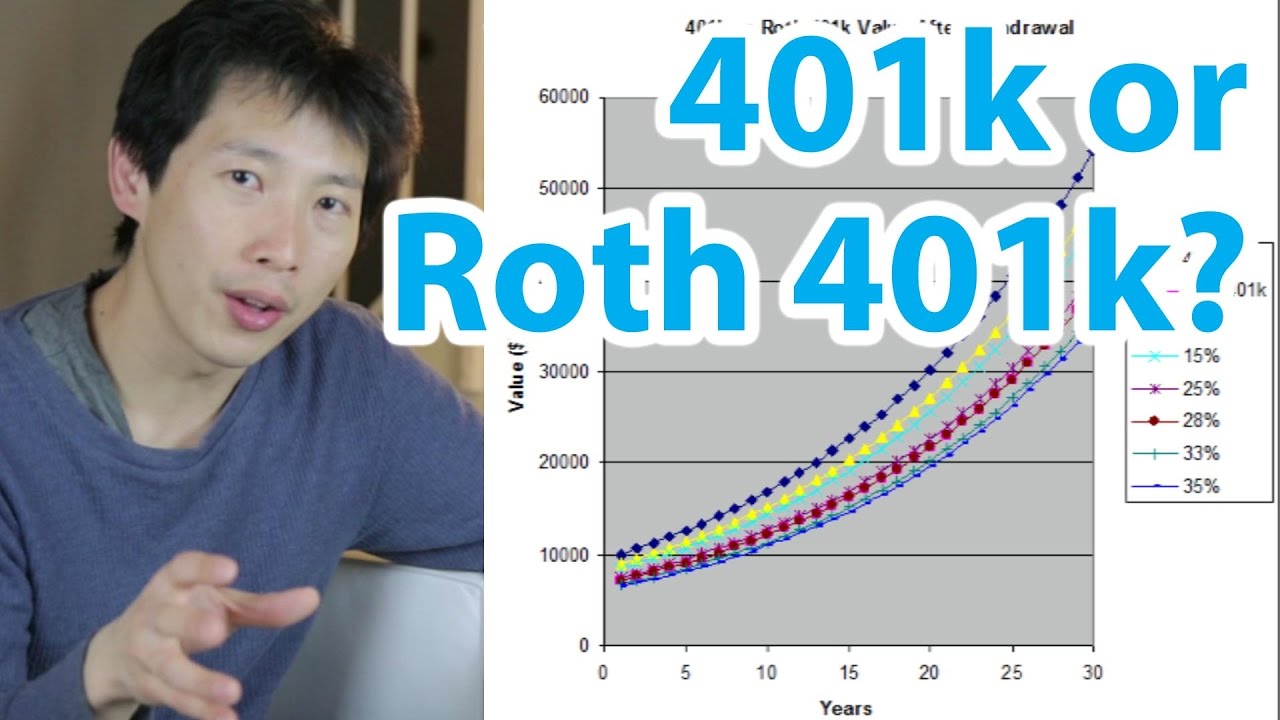

This tool compares the hypothetical results of investing in a Traditional pre-tax and a Roth after-tax retirement plan. As with traditional 401 ks Roth 401 ks require you to take a certain amount out each year once you hit 72 called required minimum distributions but with Roth 401 ks. Compare 2022s Best Gold IRAs from Top Providers.

Roth 401 k Conversion Calculator. For the traditional 401 k this is the sum of two parts. For some investors this could prove.

Compare 2022s Best Gold IRAs from Top Providers. For the Roth 401 k this is the total value of the account. The Roth 401 k allows you to contribute to your 401 k account on an after.

Roth IRA is a great way for clients to create tax-free income from their retirement assets. This calculator will help you to compare the net effects of keeping your traditional Individual Retirement Account. A 401 k contribution can be an effective retirement tool.

For instance if you expect your income level to be lower in a particular year but increase again in later years. Traditional vs Roth Calculator. With the passage of the American Tax Relief Act any 401 k plan that allows for Roth contributions will now be eligible to convert existing pre-tax 401 k.

401 k Rollover Calculator. This calculator compares two alternatives with equal out. Official Site - Open A Merrill Edge Self-Directed Investing Account Today.

If you are thinking about rolling over and are not sure what option is most financially beneficial we can help you. Ad Open an IRA Explore Roth vs. The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the conversion of.

Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. 401k and pension plans. Contributions to a Traditional 401 k or individual retirement accounts are made on a pre-tax basis resulting in a lower tax bill and higher take-home pay.

Colorful interactive simply The Best Financial Calculators. The total amount transferred will be. Ad Roll Over Existing IRA Accounts and Manage Your Fidelity Account Today.

This guide may be especially helpful for those with over 500K portfolios. Explore The Advantages of Moving an IRA to Fidelity. This guide may be especially helpful for those with over 500K portfolios.

Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Whether you participate in a 401 k 403 b or 457 b program the. Ad Learn More About American Funds Objective-Based Approach to Investing.

Traditional Vs Roth Ira Calculator

Traditional 401 K Vs Roth 401 K Ubiquity

Understanding The Mega Backdoor Roth Ira

The Ultimate Roth 401 K Guide District Capital Management

Roth 401k Roth Vs Traditional 401k Fidelity

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

401 K Vs Roth 401 K Calculator Which One Should You Invest In The Kickass Entrepreneur

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

401 K Vs Roth 401 K Calculator Which One Should You Invest In The Kickass Entrepreneur

Traditional Vs Roth Ira Calculator

Traditional 401 K Vs Roth 401 K Ubiquity

The Tax Trick That Could Get An Extra 56 000 Into Your Roth Ira Every Year

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal